With a new year and exams coming up (or for those in university like me, a new semester beginning), I’m sure you don’t want to stress yourself out with money. It’s a tough thing for a student to obtain, so many seek part-time jobs and scholarships.

Before I recommend some steps or methods on how to save money, I just want to you to know that even though it’s nice to have some money, going to school and getting something out of your education is more beneficial. Just think of it like this: you spend $500 for one course, with possibly a $70 textbook and let’s say $30 miscellaneous payments. That would be $600 of your hard-earned cash, and if you don’t know squat about the subject because you’ve been busy trying to earn money, then you’re just throwing your money at the institution overpricing your courses. So, if that’s the case then you might want to decrease the amount of shifts you have or find a different job with a more lenient schedule (or perhaps work seasonally, during the breaks, when you don’t have school work or exams to worry about).

Aside from that, here are tips on how to stop wasting money as a student!

Psychology of money

I think this is very important to understand money to avoid “useless” spending. To briefly indulge in this complicated topic, I’m just going to give you an example. Imagine spending $5 everyday for a cup of coffee. Five whole dollars doesn’t seem like much for a short-term gain of joy/waking up/etc. However when you add it up that’s $1,825, nearly $2,000 spent in a whole year, just on coffee. That’s pretty much a semester at the University of Calgary!

What I’m saying is that people usually think on the short-term of things instead of the long-term. Much like the impulsive shopper, some purchases are only to satisfy the short-term wants instead of needs. The difference between those two should be pretty obvious: needs are something that are required to survive, whereas wants are simply desires or “extras” to those needs. Of course, it’s nice to satisfy your wants, but if that is your number one priority at all times then your wallet is probably suffering big time.

Buy used

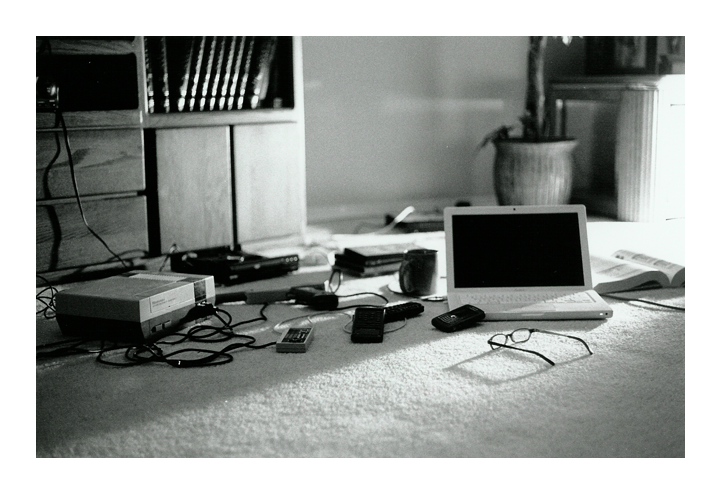

A lot of purchases these days are a waste of money. New books, video games, textbooks and even cell phones are getting pricier and pricier. If you’re a busy student, what are the chances that you’ll be reading that new (insert current popular book franchise fad) series in a month or two? If you know for sure that you won’t have time to make use of your new item, wait a month or two and see if the price drops. If not, then browse for deals (Boxing Day, end-of-the-month/year sales) or websites that are known to have deals (Amazon, Ebay, Kijiji). Even ask around, if you know your friends are filthy rich!

I’m not going to list out the stuff that you should and shouldn’t buy used, but I’m sure you can use your discretion. Remember that things get cheaper over time (especially technology since roughly every two years they come out with something new and more advanced), so instead of continually re-updating your iPhone, maybe wait for a few more updates until your old iPhone is broken or something. Not because you’re bored of it!

If you don’t like to buy things used, then try to find something that is in brand new condition, but has been previously bought. Usually items are sold less because people cannot return the item and just want to make at least some of their money back, not because they want a profit.

Stop being lazy and prepare

If you think that you don’t have time to prepare breakfast or lunch, try to make something the night before and put it in the fridge for the next day. You’ll save a lot of money by bringing a lunch instead of buying one (most meals that satisfy your tummy are at least $7) and if that extra weight of a lunch box is a pain on your shoulders, then you just have to make sure you’re carrying things that are necessary! Stop carrying that one textbook to every class when you don’t need it. You’re just straining yourself and being silly.

In addition to meals, you might want to pack a snack or two instead of spending that $2 at the vending machine. If you really like that F9 item in your school’s vending machine, find it in bulk at Costco or Wholesale. As someone who eats a lot, I tend to bring at least one item to satisfy any of my foreseeable cravings: something sweet, salty and sour. This is usually in the form of gummy candy, hard candy, chips/crackers, cookies, trail mix and so forth. I try to prepare myself for those long days at school!

Make Use of Items

Reusing is a pretty key part of saving money. Buy a good water bottle and fill it up with tap water or filtered water. If you’re preparing for a hot day at school or even relaxing at a park, put your bottle in the freezer and if you boil water but don’t want to burn yourself, pour water beforehand and let it sit on your counter until you have to go. If you are truly a coffee addict, then try to bring a reusable mug; there are usually discounts at the coffee store (even if it’s 10 cents, it’s better than nothing). If you are staying in at a fast food joint, ask for a mug (Tim Hortons offers this) and it will help both the environment and your wallet.

If you like to go shopping, make use of everything you get from the store/mall: bags can be used for garbage cans or carrying school supplies (and not just your clothes). If there are other miscellaneous objects you think you might use, you can save it for later in other circumstances. If you don’t have that ability to predict what you’ll do, then I can’t help you there.

Have fun

As a student, I get bored often. So I like to hang out with my friends! Instead of going to the mall every week, try to make these hang-out days a treat; after exams, celebrate by going somewhere. You might have to spend $20 on that day, but it is ultimately cheaper and more rewarding than spending at least $5 every week at the mall (I know it doesn’t get you much, but let’s just say hypothetically).

If you like to watch movies, try to avoid movies that you know will have a DVD release within 1-2 months. Genres include romantic comedies, children movies and Twilight. If you have good self-control, go to the movies only if you really want to see it. And even if you have two different “groups” of friends, try to avoid watching the same movie twice. Even if you really like it. Get the DVD in that case!

Better items, bigger purchases

People tend to avoid spending $50 on an item when you can buy a similar one for $10. But what if you had to replace that $10 ten times in a year, versus never replacing that $50 item? I know which one is a better money-saving technique! Seriously though, stop spending money on cheap items made from China and start thinking about where items come from. Wal-Mart might be cheap, but are the items of high quality? Not usually. And even though designer jeans can last a while, you could at least wait for a sale instead of shelling out $200 for something you might not wear a lot.

Invest in good items and do not be afraid of spending a huge amount of money in one item. You will probably save more money that way because the better product outlasts the cheaper product. Usually reusable batteries save you money on the long-term.

So that’s basically all I have! If you have any more, feel free to comment below. If you skipped everything I wrote then at least remember this: Think of the long-term savings rather than the short-term satisfaction.